November 24, 2025

The Q4 paid social trap: why planning habits are rinsing your budget

You are not imagining it. Q4 paid social feels like someone quietly doubled the price of eyeballs, then asked you to hit a higher target with the same budget and fewer people.

It’s easy to say that is, “just how it is in Q4”. The assumption is that you can’t control costs, you just have to hustle harder in the auction. That assumption is costing you real money.

What if the problem is less about platforms and more about planning habits you can actually change?

Plan for better paid social

Q4 isn’t broken, the auction is doing its job

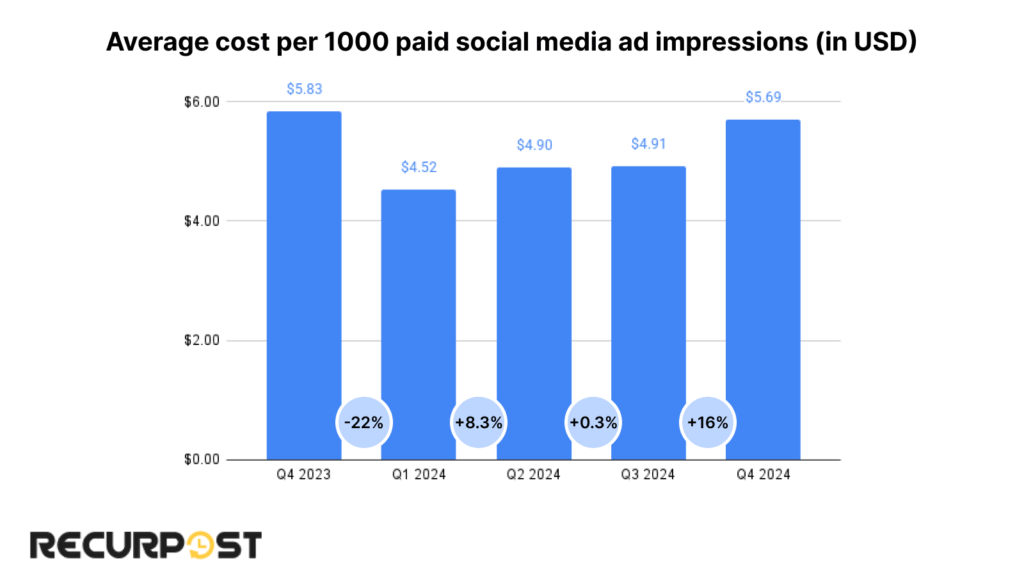

Every fourth quarter, the same pattern repeats. Meta CPMs climb through autumn, then spike around Black Friday, Cyber Monday and the first half of December. Hootsuite’s data shows Facebook CPMs peaking in late November and staying painfully high for weeks as everyone keeps pushing Christmas offers.

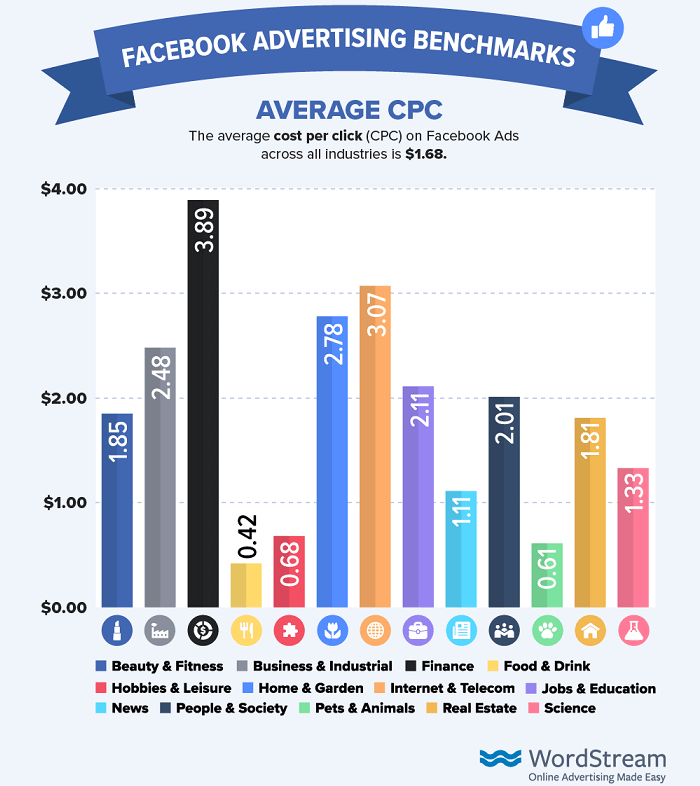

Across platforms, cost per click in Q4 typically rises 30–60% versus mid‑year averages, with the biggest jumps on peak shopping days when every brand piles into the same auctions.

You can see the knock‑on in performance stats. Benchmark data points to an overall average ROAS around 4.2:1 across social platforms in Q4, with higher returns on LinkedIn for B2B and Pinterest or TikTok for high‑intent consumer buys.

None of this is a glitch. Social auctions are built to respond to demand. When inventory is finite and every retailer, travel brand and fintech is bidding hard, the price climbs. The auction is behaving exactly as designed.

The quiet penalty of living only in the auction

Most brands run the bulk of their Q4 media in the default mode: auction only.

That’s fine in shoulder seasons. You can test, tweak and exploit dips. In Q4, when the market is at its loudest, it becomes a trap.

Auction‑only buying creates three big problems for you as CMO:

- You lose predictability. Your cost base moves daily, sometimes hourly. Finance can’t forecast with confidence, and you can’t walk into a board meeting with a sane view of what £300k will actually buy in December.

- You bake in creative chaos. When everything is last‑minute and prices are climbing as you brief, you push teams into rushed assets and shallow testing at the exact moment the work needs to be sharpest.

- You give up control. You can’t say “for this budget, we will reach these people, this many times” because you’re throwing everything into a live auction at the most volatile moment of the year.

In other words, you carry all the commercial pressure of Q4 with none of the control. That’s the real Q4 paid social trap.

The feature social already has that most brands ignore

This is where I bring in CJ, our MD who lives and breathes paid strategy.

“In the TV and radio world, no one dreamed of buying Christmas spots in November. You booked months ahead. You fixed your prices. You knew roughly what you were getting.”

CJ’s point is that Meta still lets you behave like that. We just forget to use the feature.

Instead of throwing everything into live auctions, you can use Reservation buying (the evolution of Reach and Frequency) to lock in campaigns in advance. You can:

- Reserve campaigns up to 180 days ahead

- Run them for up to 90 days

- Fix your CPM with predicted reach and frequency

- Cancel before they start if you absolutely have to

Meta’s own documentation confirms it. You can pre‑book Reach and Frequency style campaigns up to six months in advance, with durations up to 90 days and minimum audience sizes (typically 200,000+):

https://en-gb.facebook.com/business/help/251123081984768

https://www.facebook.com/business/help/1720490018221511

CJ summed it up perfectly in a note to me:

“Brands should pre‑book their Reach and Frequency campaign. You can do that up to 180 days in advance, but it requires creative to be locked down by the point of booking. Too few brands work that far ahead, and end up paying the inflated bid rates because of it.”

He’s blunt about the numbers too. Based on our work and a recent call with Meta, his view is that brands who reserved early for this Q4 saved a minimum of 40% on CPMs versus those who ran auction only. For mainstream consumer audiences, that saving can easily approach 60%.

Same budget. Much wider audience. Far less volatility. The market hasn’t changed, you’ve just stopped buying all of your inventory in the most expensive possible way.

The real problem isn’t platforms, it’s planning habits

There is a catch, and it’s where the real tension sits. Reservation only works if you have your creative and campaigns planned when you book.

That’s where most organisations fall over. Because social can “go live tomorrow”, teams have drifted into short‑term behaviour. Assets cleared late. Strategies still being debated in October. Christmas paid plans casually briefed in September with “flexible” objectives.

Leadership doesn’t see the cost of delay. No one has a KPI that says “lock Q4 creative and media by June so we don’t get rinsed in the auction”. Your team does its best inside that chaos and, by the time the numbers look ugly, there’s no time left to change the buying model.

What looks like “Q4 is expensive” is often “we left it so late we had no other choice”.

Q4 paid is also a people problem

There’s another layer here. Your media and social teams are tired.

Studies from Brandwatch, Digital Information World and others show bandwidth and resources as the top social challenge. Around 40–50% of marketers say they’re stretched too thin across content, video and multi‑platform management:

On top of that, roughly 45% of marketers are already leaning on AI just to keep pace with demand:

Throw late Q4 planning and auction volatility into that mix and you get exactly what you’re probably feeling: Q4 as a stressful, unpredictable, budget‑hungry mess.

A different way to design Q4: backbone and edges

Stop thinking of Q4 social as one big campaign that has to fight entirely in the auction. Treat it as a portfolio with a backbone and edges.

The shape we use with clients looks like this.

First, a guaranteed backbone. Use Reservation for the moments that genuinely matter for your category – Black Friday week, early December gifting, specific paydays or industry peaks. Fix a meaningful portion of budget into pre‑booked reach and frequency so you’re not walking into the most expensive weeks with zero protection.

Second, agile edges in auction. Keep a proportion of budget in auction for tactical moves. Respond to trading, stock, competitor behaviour and real‑time signals. Use this space to test creative variations and audiences while your backbone quietly delivers the reach you promised.

Third, deliberate learning in the cheaper months. Use Q2 and Q3 to test hooks, formats, creators and audiences. Roll the proven winners into your Q4 backbone, so Reservation is backing ideas you already know can earn their keep.

You’re no longer exposing 100% of your budget to the wildest pricing period of the year. You’ve built a spine of certainty and a playground for experimentation.

The board conversation shifts when you frame Q4 as risk, not fate

This is where it gets useful for you in the C‑suite.

If you present Q4 as “CPMs are going up so we need more budget”, you get pushback. Quite right too. If you present it as a risk management choice, the conversation changes.

You can say:

Benchmark data shows Q4 social costs rise 30–60% versus mid‑year. We can either expose 100% of budget to that volatility, or protect 50–70% with pre‑booked CPMs. By committing earlier, we either save around 40% of media cost or buy 40% more reach for the same budget.

That’s a business decision, not a marketing plea. It’s also a far easier story for you and your CFO to stand behind.

This is the knot we help clients untangle.

At Immediate Future, we live in the space between platform mechanics and boardroom reality. We help CMOs protect Q4 budgets from the worst of the auction, while giving their teams enough freedom to stay creative and responsive.

That usually means mapping where Q4 is genuinely worth paying the seasonal premium, designing a Reservation‑plus‑auction mix that your CFO can sign off, building creative that earns trust and attention when attention is most expensive, and putting measurement in place so Q4 learning compounds into the following year.

If you recognise the Q4 paid social trap in your own organisation, the good news is it’s fixable. You don’t have to keep paying the chaos tax.

And if you want a sounding board on how to reshape next year’s Q4 plan, I’m always up for a proper chat.