October 10, 2025

I love a tidy funnel model. Boards love a tidy model. Buyers don’t care. They move in loops, threads and group chats; they binge three PDFs, watch a creator, ask a mate on Slack, then type your brand name into search two weeks later. If you plan social like a straight ladder, you’ll miss the moments that matter.

The Marketing Society’s CMO conversation was on funnel strategy, and three lines stuck:

- “Familiarity is not a bonus. It’s the entry fee.”

- “Brand does drive interest, does drive clicks, does drive downloads… [so] think about it as one continuum.”

- “Search is resulting in zero clicks. we’re seeing a decrease in organic traffic [and] a large increase in visits driven by brand search terms.”

As Ben Munroe CMO at Cloudflare said, the job is about creating gravity so buying groups know you, then create velocity so opportunities happen faster.

What actually changed (and why your social plan must follow)

The buying room got bigger — and quieter

It isn’t one lead; it’s a rotating committee. Finance, Legal, Security, RevOps, FinOps. Sandeep Pal CMO at FlexxCMO spelt it out. Hidden buyers influence the call, and they need to know you.

They need to understand you. I mean, familiarity is not a bonus. it’s the entry fee. and I feel that especially if you look at even the stats, LinkedIn did research and found that 81% of the winning deals shows that everyone, or almost everyone on the team, already knows the brand.

LinkedIn × Edelman’s 2025 study backs this up and adds that deals stall when buying groups can’t reach consensus It’s clear hidden buyers are often the gap. edelman.com

Brand and demand are now the same race

Ben’s point was practical, not poetic: “Brand does drive interest, does drive clicks, does drive downloads…” so plan “from brand all the way through to your revenue metrics.”

Treat brand as pull that expands the prospect pool and raises conversion rates when you switch on capture tactics. It’s one system.

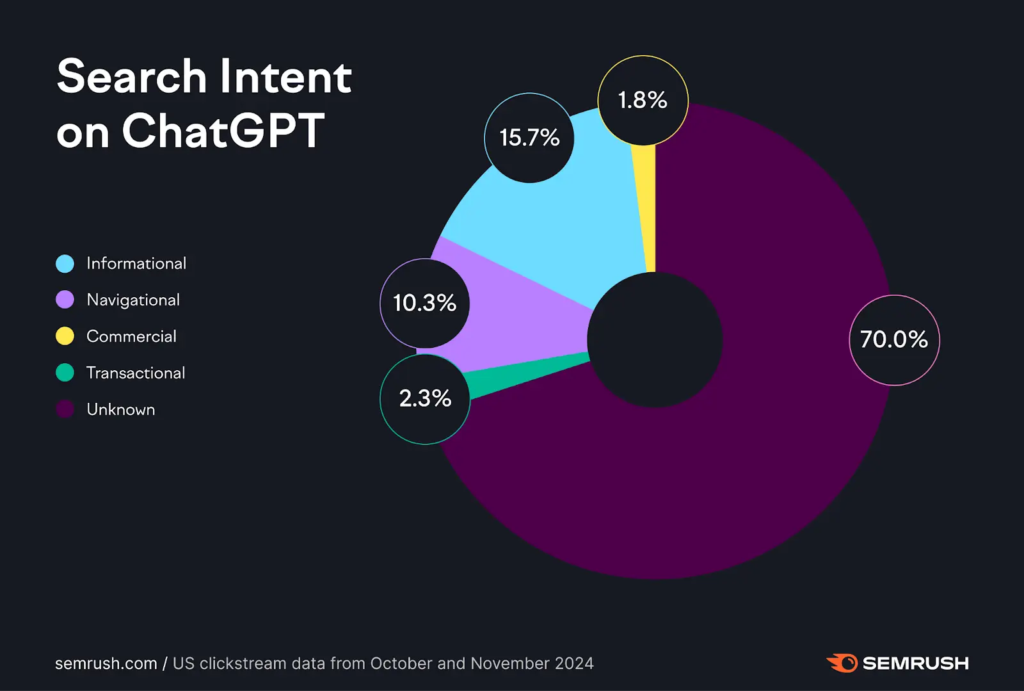

Answer engines reshaped the dark funnel

Buyers are learning off-site. LLM answers, Reddit threads, review sites, industry forums.

As Ben put it, “search is resulting in zero clicks” and the signal is a rise in branded search even while generic organic fades.

AI Overviews change how people finish a search. On many informational queries, the answer appears on the results page, so fewer people click through. The effect isn’t uniform. Some topics barely shift, others see a clear dip.

You have to monitor at query-cluster level. When an overview appears, turn your goal from “win the click” to “be cited and remembered.” That means a canonical Q&A on your site, clear headings, short summaries, and credible sources.

Then use social to carry the same answer through the buying group. Post the explainer as a carousel and a short video, let employees and creators add context, and expect saves and sends to rise even if clicks don’t. Track branded search lift, account activity and time to opportunity alongside CTR. You’re proving influence where the journey actually happens, not just where it’s easy to measure.

There’s a broader market signal too: multiple outlets reported a sharp drop in ChatGPT’s Reddit citations in late September, discussed alongside a parameter change in Google indexing, with RDDT wobbling on those headlines. Whatever the root cause, the lesson is the same, AI visibility is now a dependency. Don’t put all discovery in someone else’s hands.

So what does this mean for social?

A. Build gravity for the whole buying group

Social is how you earn familiarity at scale. Not nose but useful proof in public.

- Programme content for hidden buyers. Finance/FinOps care about unit economics, risk and optimisation. Edelman × LinkedIn highlight the hidden buyer gap and the need to equip consensus. edelman.com

- Creators and employees carry trust. Your experts and partner creators move quickly across the room. They spark saves and sends (the behaviours that predict pipeline).

B. Run a double funnel: create pull, capture demand

Don’t make brand wait for performance to finish. Run both. Flood the funnel

- Create pull. Advice-first video, POV posts, carousels with one strong stat and a clear next step.

- Capture demand. Offer pages, comparisons, calculators, demos , and yes, link posts. Platform evidence is clear:

- Galleries and PDFs over-index on engagement and impressions (great for memory).

- Link posts win on clicks and still perform solidly on reach; you need them to harvest intent.

C. Optimise for Answer Engine Optimisation (AEO)

If buyers get their bearings from LLMs, give models something cite-worthy.

- Create canonical Q&As on your site with clear headings, references and short “answer cards.”

- Mirror answers on social as carousels and short clips. That repetition strengthens entity signals and nudges LLMs (and humans) the same way.

- Track the right leading indicators: branded search lift, saves, sends, share of voice; they’re the early smoke for revenue fire.

Operating model tweaks that unlock all this

Put Finance in the loop and aim at ACV (annual contract value)

I focus on ACV, and that becomes the true north… revenue as your agreed ultimate success metric

said Ben.

Use the funnel as a signpost; if revenue is growing, double down on what accelerates velocity. If not, add visibility to the dark funnel (brand search, social interactions, review site referrals) inside your CRM.

Personalise by pattern, not persona theatre

Replay your closed-won paths (replace the funnel). Which content sequences preceded opportunities in each industry? Recreate those sequences in social: same beats, new stories. That was the spirit of the discussion around using AI to mine call recordings and first-party intent, instead of carpet-bombing with third-party lists.

Balance brand vs demand by life stage

“Smart, successful CMOs” balance the mix by category and lifecycle; if inbound is hot, you don’t pour money into the wrong bucket. Plan brand-to-revenue as one continuum and report it as such.

Hidden-buyer content matrix (table)

So how do you make this all work, especially when looking at buyer groups who may be hidden.

We know big B2B decisions aren’t made by a “lead” or in a linear funnel; they’re made by a room. Finance, Security, Ops and the sponsor each need different proof before they’ll say yes. The matrix (example below) forces you to design social for the whole room, not the loudest voice. It maps what each function needs, the public signals you’ll show on social (so content is easy to save, send and defend in meetings), and you can add the owned asset that backs it up and addresses the objection you’re neutralising, and the metric that tells you it’s working.

Use it to steer planning, brief creators and employees with clarity, and report progress in language the CFO respects.

| Buyer in the room | What they need to say “yes” | Objection to neutralise | Metric to watch |

| Finance/FinOps | Unit economics, payback, risk | “Hidden costs. Long payback.” | Branded search from finance titles; ACV-weighted opps |

| Security/IT | Compliance, integration path | “Integration pain. Data risk.” | Time from tech view to demo; technical page depth |

| Operations | Implementation clarity, disruption window | “We’ll lose time and miss SLAs.” | Post-view meeting requests; enablement downloads |

| Business owner | Outcome proof, category fit | “It’s nice, but not for us.” | Share of voice; category keywords shifting to brand |

If you only remember three things

- Win the room. Social must make you familiar with hidden buyers, or the deal never moves. “Familiarity is not a bonus. It’s the entry fee.”

- One continuum. “Brand does drive interest, does drive clicks, does drive downloads” — plan brand-to-revenue as one system.

- Be in the answer. Zero-click behaviours and AI answers make AEO non-optional. If models can’t see you, your gravity weakens.