May 1, 2025

(and actually win them over)

It is a truth universally acknowledged (and quietly cursed under many a marketer’s breath) that CFOs find marketing baffling. Not because they do not understand business. Quite the opposite. It is because marketing too often speaks in a foreign tongue of impressions, engagement rates and follower counts.

A world light-years away from EBITDA, cost of capital and margin improvement.

After twenty years in social media marketing, I can tell you: winning over the CFO, and the boardroom more broadly, is not about dazzling them with dashboards. It’s about translating social media into the cold, hard language of business value. And doing it crisply. Pithily.

Without a single whiff of waffle.

Let’s get serious though, if your “big win” is 100,000 followers and no impact on the pipeline, you will not get budget. Or a seat at the table. You will get a polite nod.

Here’s how to shift that narrative.

Table of Contents

Step 1: Ditch the vanity metrics

Followers, likes, views. They all have their place. But not in a conversation with a CFO. These metrics are proxies, not proof. Gartner found that only 42% of marketing metrics are considered useful by senior finance leaders. Why? Because most traditional social metrics are too abstract.

When speaking to the board, you must show cause and effect. Activity must tie directly to outcomes that affect the P&L: revenue growth, customer acquisition, retention, and cost efficiencies.

Table: What not to show vs what to show

| Vanity Metric | Business Metric |

| Number of Followers | Leads generated via social media |

| Post Impressions | Cost per lead (CPL) |

| Video Views | Pipeline influenced by social |

| Engagement Rate | Revenue attributable to social |

Golden rule: if you cannot link a number to either cost savings, revenue generation or risk mitigation, do not put it in front of your CFO.

Step 2: Set sharp, business-aligned goals

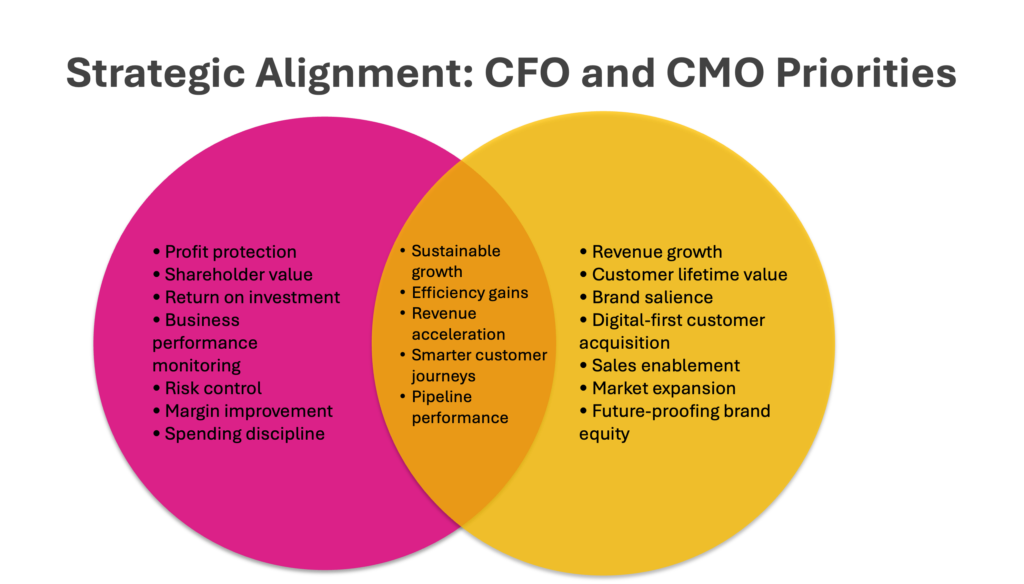

Social media marketing should never live in a parallel universe from the business plan. If your CFO’s targets are revenue growth and margin improvement, your social media goals need to feed into them.

As CMO Alliance highlights, marketers who align KPIs to business outcomes (like customer acquisition cost (CAC), lifetime value (LTV) and pipeline coverage) are significantly more successful in securing buy-in.

Table: Translating Social Goals into Business Language

| Social Goal | Board-Ready Business Goal |

| Increase brand awareness | Expand mental availability to grow market share |

| Grow audience engagement | Build lead pipeline and improve conversion rates |

| Launch new video campaign | Shorten sales cycles by addressing objections early |

In short, put your goals in terms your CFO can put into a forecast spreadsheet.

Step 3: Speak their language

CFOs are not your enemies. They are natural sceptics tasked with protecting the business. To earn their trust, you need to speak finance, not marketing.

According to Forrester, marketers who engage directly with analytics and measurement are 1.4x more likely to prove their value to the C-suite.

Here’s how to frame your social media pitch:

- Talk about efficiency.

How much does it cost to acquire a customer through social media versus other channels? - Talk about growth.

How much revenue has social-driven content contributed to the pipeline? - Talk about risk.

How is your social presence mitigating brand risk or reputational damage?

Avoid phrases like “engagement strategy” or “fan growth” unless you immediately tie them to a financial impact.

Example:

“Our LinkedIn campaign generated 120 MQLs at £37 per lead — a 28% lower acquisition cost than paid search, improving marketing efficiency this quarter.”

That is music to a CFO’s ears.

Step 4: Prove short-term wins and long-term value

CFOs are realists. They want immediate results, but they are also responsible for sustainable, defensible growth.

Social media can deliver both. You just have to show it.

| Timeframe | What to Prove |

| Short-Term | Leads, conversions, event attendance |

| Mid-Term | Reduced acquisition costs, improved retention |

| Long-Term | Increased brand salience, higher LTV |

As LLR Partners point out, a marketing investment that lowers CAC and lifts LTV is the kind of double-dip CFOs love.

Real example: A social-driven customer advocacy programme that boosts customer retention by 5% can increase profits by 25% to 95% (Bain & Company).

You must make those connections explicit.

Step 5: Build a single version of the truth

Nothing erodes board confidence faster than fuzzy or conflicting data.

Marketing needs to operate from unified dashboards, not five different reports stitched together with hope and elbow grease. As Digital Defynd stresses, unified, credible reporting is critical to aligning marketing and finance.

Key metrics to include in your CFO-facing dashboard:

- Pipeline attributed to social media campaigns

- Cost per acquisition (CPA) by channel

- Return on ad spend (ROAS)

- Brand health metrics linked to sales growth (e.g., uplift in consideration rates)

Always show trends over time and benchmark against targets. Context is king.

Step 6: Tell a story (but keep it taut)

Remember: data gets you in the door. Storytelling gets you the budget. There is more on creating stories from data that is perfect for tackling the CFO in this blog.

Frame your results as a business journey:

- Challenge: “Our organic reach was stagnating, and paid costs were rising.”

- Action: “We launched a targeted advocacy campaign with sales and marketing alignment.”

- Result: “Lead generation rose by 18% and CAC dropped by 12% quarter-on-quarter.”

No waffle. No clutter. Straight to the point. Crisp storytelling framed around business impact is what sticks in the board’s memory.

Common mistakes to avoid

Mistake 1: Overloading with data

More slides do not equal more credibility. Sharp, headline figures with clear context are far more persuasive.

Mistake 2: Assuming CFOs “don’t get” marketing

Wrong. They do get business. You must meet them halfway. If you cannot draw a clear line from activity to value, that is a marketing problem, not a finance one.

Mistake 3: Leading with tactics, not strategy

Boards care about outcomes. Not whether you posted 16 times on Instagram last week.

Your job is translation, not just execution

Social media marketing is at a crossroads. Those who treat it as “just posting” will increasingly be squeezed out of boardrooms and budgets.

Those who treat social as a strategic lever for business growth, and can prove it in hard financial terms, will become indispensable.

It’s not about pretending social is something it is not. It is about showing, plainly, sharply, pithily, that mental availability, brand salience, customer acquisition, retention and loyalty are business critical outcomes. And that social is one of the smartest, most efficient ways to achieve them.

You do not need a hundred slides. You need a handful of killer points that land.

Or to put it bluntly: If you want the CFO to back your social strategy, you must stop sounding like a marketer, and start sounding like a businessperson who happens to know a hell of a lot about marketing.

And after twenty years, trust me: it works.

Citations: