October 1, 2025

Make social the engine room of growth

I’m thrilled budgets are shifting to social; I’m less thrilled by the pressure on lean teams. The board isn’t being awkward, they’re being rational. They want growth. If social now commands a bigger slice of spend, the plumbing must match the promise. Cloud Insight

That means cleaner data joins, braver creative, and a reporting spine that speaks revenue, efficiency and risk. In 2025, social ad spend is projected at about $276.7bn; scrutiny scales with that figure. Sprout Social

Why the money is really moving

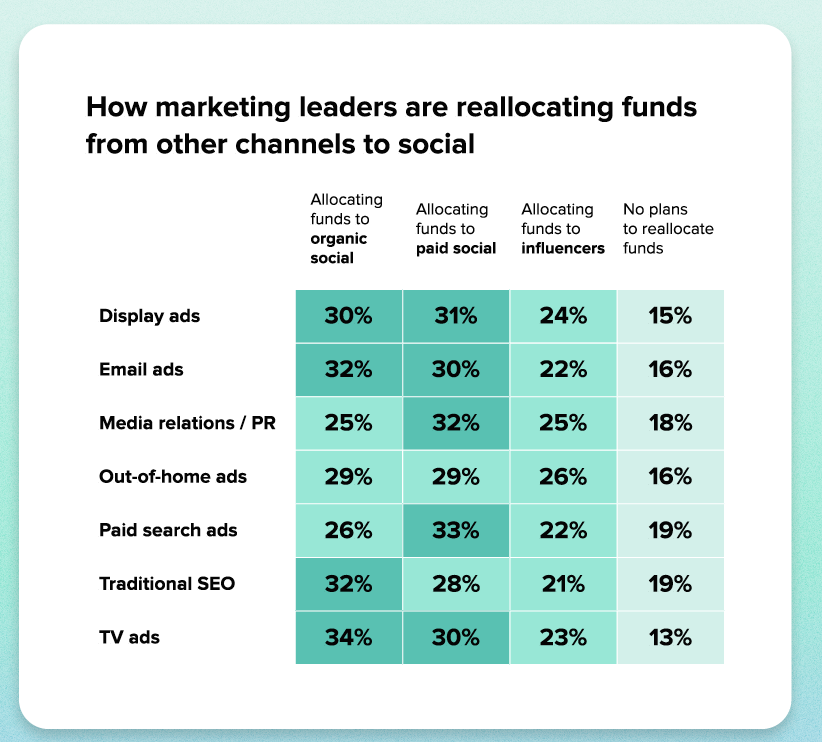

Leaders have twigged that discovery, decision and loyalty now play out on social, and the budgets are catching up. Four in five marketing leaders are actively shifting money from other channels into social. It’s a bloomin’ big change too. Apparently 87% plan to increase paid, just over 80% will lift influencer and organic, and 85% think they need presence on more networks to maximise business impact.

If you feel the stretch on your team, you’re not imagining it. Three-quarters of brands expect to add social headcount this year, with hiring skewed to social search optimisation, analytics, and paid, not just “more posting.”

And yes, search behaviour has moved. Eighty-one per cent are diverting from traditional SEO into SOSEO and creator programmes; over half already run a social-search strategy, and another 43% are testing.

In the UK, TikTok tops the business-impact table at 66%, with Facebook and YouTube close behind; B2B leaders still crown LinkedIn, while YouTube and Reddit are climbing as evaluation hubs.

The value gap is structural, not creative

Gosh, I hate to say it, but it’s the ops leak that is costing you growth in so many cases. Only 2% of leaders say data flows cleanly across their stack; the rest of us are stitching screenshots together like it’s 2015. Nearly half still pull reports manually. In the last year, 97% hit customer-facing martech errors and a quarter lost customers because of it. That’s not a creative problem, it’s an operating problem.

Ideally you’ll need to…

- Make one clean join from social to analytics to CRM; stop exporting and start attributing. Less than half of teams embed social data into any CRM, which is why finance “can’t see” you.

- Kill manual reporting. Forty-eight per cent of leaders say teams still waste time pulling reports by hand; reclaiming those hours is your quickest productivity win.

- Measure what money cares about. Expert teams bias to revenue and efficiency metrics and become more strategic as data literacy rises; that’s the loop you want.

Post less, prove more

Leadership instinct pushes cadence, but the evidence keeps nudging us toward craft if you want business growth. Publishing fell while engagement rose nearly 20% year on year, which tells you quality and intent beat volume any which way you look at it. Sprout Social

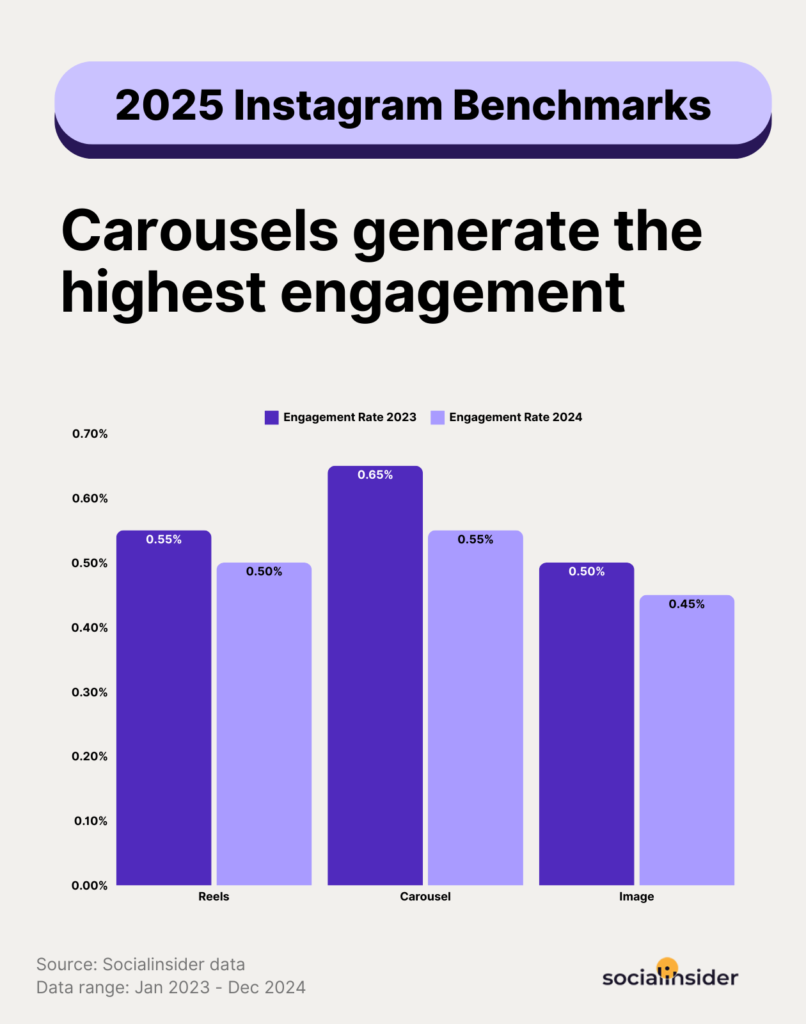

On Instagram the bar is higher. Average engagement hovers around 0.45% in 2025 H1, and carousels are doing the heavy lifting for saves and depth; saves are your “I’ll use this later” signal, not a vanity bump. Socialinsider

Rival IQ’s 2025 benchmark backs it up. Every major platform saw engagement rates slide, yet carousels quietly outperformed Reels for many categories; the multi-frame format gives you room to answer real objections, not just entertain. Rival IQ

So design content to help someone decide, not just scroll. Think chaptered explanations, comparison frames, proof in context; then make sure the signals travel.

- Treat saves, sends, and profile clicks as intent signals to nurture, not endpoints to celebrate. Cross-check them against session quality on site.

- Wire those signals into CRM so finance can see the story without a translator; leaders want ROI tied to business outcomes, and less than half rate their teams “expert” at proving it. Sprout Social

- Close the loop with proper attribution and cleaner joins. If social data doesn’t land in your customer record, your best work disappears in the board deck.

Bottom line. Post less, answer more, and let the right metrics earn you the right budget. When the content resolves decisions and the data lands in CRM, the growth impact shows up where it matters.

Measure what money cares about

Let’s point the scoreboard at outcomes the business already tracks. Keep it simple, consistent, and visible to finance.

What to measure, and why it matters

- ROAS and incremental profit, so spend decisions aren’t guesswork.

- Assisted pipeline and opportunity creation, to show where social helps progress deals, not just start them.

- Win-rate lift on socially touched opportunities, because confidence at the point of choice is the real value.

- Time-to-close measures, to prove social shortens the journey.

- Branded and category search growth after campaign bursts, as the early signal that demand is moving.

Oh and don’t forget to use benchmarks to make your case even stronger with your leadership team.

2025 social media ROI benchmarks vary significantly by industry, campaign type, and platform, with e-commerce, retail, and influencer-driven segments leading the field. On average, brands across all sectors see $5.28 in return for every $1 spent on social media advertising, with some sectors outperforming this mean considerably. sqmagazine

ROI Ranges by Industry (2025)

| Industry | Average ROI Range (per $1 spent) | Notable Channel/Trend | Citation |

| E-commerce | 250–400% | Instagram Shops, TikTok ads | socialbu |

| Retail | 150–300% | Pinterest, Shoppable posts | sqmagazine |

| B2B | 80–150% | LinkedIn, Whitepaper downloads | socialbu |

| Healthcare | 100–250% | Educational content, trust | socialbu |

| Food/Restaurants | 200–330% | Instagram, TikTok | sqmagazine |

| Financial Svcs | 130–290% | YouTube, Thought leadership | socialbu |

| Influencer Mkting | $5.78 per $1 spent | Instagram, TikTok creators | sprinklr |

Design for discoverability and decision

People don’t just “see” you on social, they search you, test you, and decide if you’re worth their time.

Build for that moment.

Think chaptered explainers on YouTube that answer one clear question at a time; save-worthy Instagram carousels that tidy up confusion; creator demos that remove objections; and threads in the places where evaluation actually happens.

Aim for signals that prove momentum, branded and category search lifting after a burst, qualified sessions that stick around, assisted conversions showing up in your pipeline.

Teams are already shifting budget from classic SEO into social-search optimisation and creator programmes, because that’s where decisions that impact growth, are being made now.

Have a look at the Social search FAQs if you want to know more

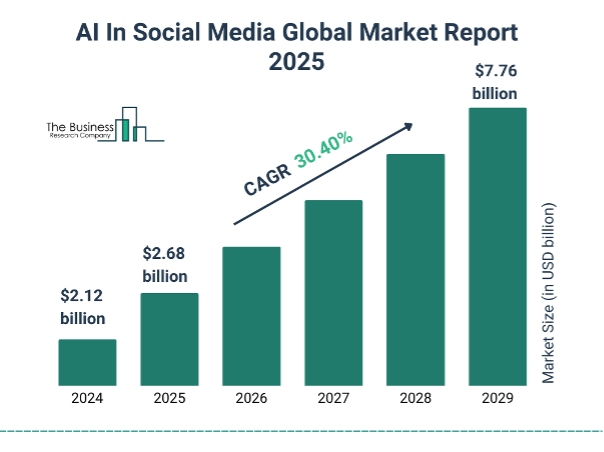

Let Ai do the graft, keep humans on judgement

I’m all for automation that speeds learning, I’m just not handing over the keys to a black box. We’ve seen too many “optimise first, explain later” roll-outs create customer issues and messy reporting. In 2025, most leaders reported AI-related customer problems; the root cause wasn’t creativity, it was governance and visibility.

What we’ll back

- Human-set guardrails; machine-run chores. Use automation for variant generation, pacing and routine testing, but keep targeting logic, exclusions, and brand safety under human control. WARC’s analysis of ad-platform automation calls out hidden costs, performance volatility, and waste when marketers cede too much control. WARC

- First-party models over platform black boxes. Prioritise audience building and bidding rules powered by your own data, then syndicate segments to platforms. It’s safer in a cookie-fragile world and it’s explainable in finance.

- Transparent testing, not “trust us.” Run pre/post or holdout designs and incrementality reads that live in your analytics layer, not just in Ads Manager. Sprout’s leadership research shows teams become more strategic as data literacy and independent measurement rise.

What we’ll avoid (for now)

- Fully automated “just plug it in” campaign types where you can’t see, steer or suppress. Marketers are pushing back on black-box setups because they reduce control of placements and audiences, and make it harder to prove incremental value.

- Policy-volatile dependencies. Platform rule shifts can change overnight; witness Meta’s EU ad policy moves this year. If your plan relies on one vendor’s AI logic, your risk surface spikes. Keep optionality. Financial Times

Use AI as a creative and optimisation exoskeleton, not an autopilot. Keep people on the judgment calls; keep automation on the chores; keep measurement in your house.

That’s how we move faster without losing the plot.

Platform shifts that matter to strategy

This isn’t a “what’s new” list; it’s a board-facing view of where social is pulling its weight and where it can trip you up. Read the middle column first to decide your next move for growth; then glance right for how you’ll prove it.

| Platform | What changed (with data) | Strategic move now | Success signals | Watch-outs |

| Meta | Platform automation is now the default, but marketers are flagging black-box trade-offs: control, explainability, and waste when inputs are weak. Treat automation as an accelerator, not an autopilot. | Build modular creative “spines” you can iterate; keep targeting logic, exclusions and UTMs under human control; scale only when incremental conversions rise while CPMs hold. | Conversions up with flat/down CPMs; lower cost per incremental outcome; fewer fatigue spikes; consistency between platform and independent analytics. | Over-relying on platform AI for targeting/placements; IG+FB audience overlap that fakes scale; messy UTMs that break attribution; policy shifts that change rules overnight. |

| TikTok | UK leaders rank TikTok the top platform for business impact; many are reallocating from classic SEO into social search optimisation and creator programmes as evaluation moves on-platform. Sprout Social | Use creator explainers that handle objections; connect cleanly to Shop; judge beyond plays with assisted conversion and search signals. | Assisted conversions and basket adds; lift in branded and category search during bursts; higher qualified session depth from TikTok referrals. | Trend-chasing without product detail; siloed reporting that hides assisted value. |

| Benchmarks show engagement down year-on-year (avg ≈0.45% H1’25), while carousels lead for saves, the strongest “use later” intent. Rival IQ also reports carousels topping post-type engagement. | Prioritise save-worthy carousels and guides; amplify only proven posts; treat saves/sends as nurture triggers into email/retargeting | Save and send rates up; improved conversion from social; steady cost per incremental add-to-basket. | Over-weighting Reels vanity metrics; boosting before proof. | |

| YouTube | Regaining ground in consideration journeys; pairing Shorts with chaptered long-form improves reach plus authority for research-driven decisions. (Also echoed in leadership surveys on where buyers evaluate.) | Chapter long-form proof; pair with Shorts to seed discovery; align end cards to demo or comparison journeys; track search lift and qualified requests. | Lift in branded search and demo requests; higher win-rate and shorter time-to-close on socially-touched opps. | Optimising for views over intent; orphaned videos with no follow-on journey; weak chaptering. |

Social is no longer a content factory; it’s the connective tissue of growth. It stitches discovery, evaluation, purchase and loyalty into one living system, and the thread runs through your data, your teams and your customers’ daily habits.

Leaders already see it; 80% are moving budget from other channels into social, with 87% increasing paid and just over 80% lifting influencer and organic.

Fix the joins, back the brave work, and report for results. That is social growth