January 16, 2023

The sober movement is growing… it’s more than just Dry January or Sober October!

The growth of non-alcoholic drinks is about consumers having more choices. Driven largely by Gen Z, it’s interesting to see that males aged 18-34 are the most likely to trial no/low-alcohol drinks, and in fact, stats show that nearly 20% of youngsters never drink alcohol.*

However, Pinterest is also seeing interest rising in Gen X, with terms and boards such as “Fancy non-alcoholic drinks” up +220%, and “Mocktail bar” by +75% in September 2022.*

What’s important in a “soft” drink?

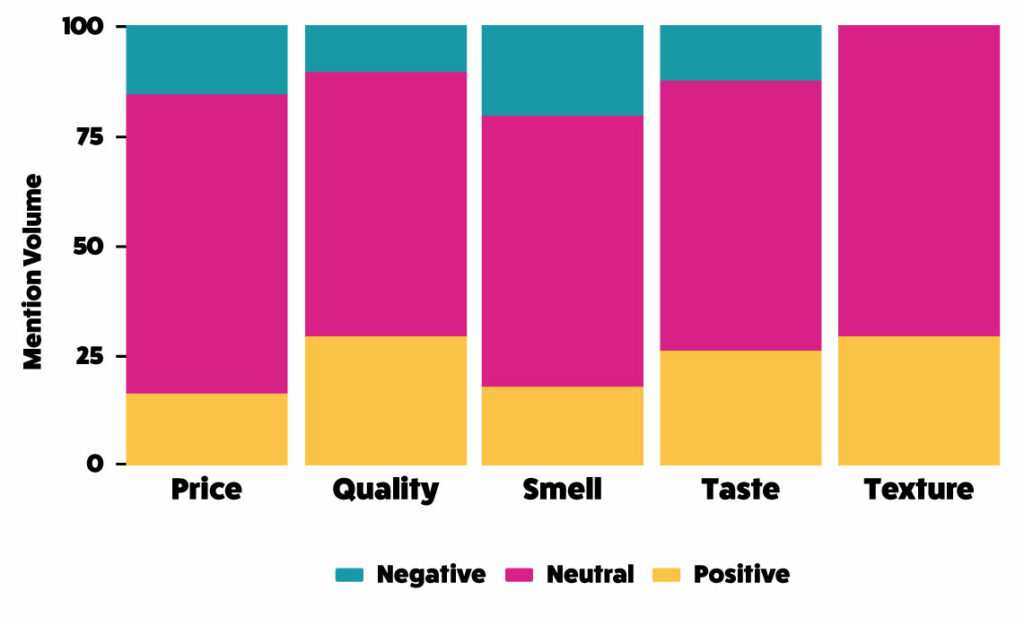

Even with the cost of living crisis hitting hard, price isn’t a key factor – only 5% of conversations on social mention penny-pinching. In many cases, the quality and taste are mentioned in a positive light, but the smell can be polarising with 29% negative and 25% positive mentions.

Over the lockdowns, we saw zero alcohol spirits increase in mentions, but more recently in late 2022, consumers were turning their attention to no/low-alcohol cocktails (+52%), wine (+75%) and beers (+34%)… gin mentions were trending downward at -11%, which could be seasonal, we’ll keep an eye on it.

A different kind of buzz

It does seem we’re still looking for ways to wind-down, down or rev up when it comes to avoiding alcohol, however. Mentions of alternatives like CBD, Reishi, Adaptogens and Ashwagandha-infused drinks are increasing as consumers are open to trying something new, and perhaps more exciting that the standard soft drinks.

Staying in the basket

Brands should be keeping a close eye on social conversations for opportunities to tap into the consumer mindset.

There’s no denying the power of social – having a good experience with a brand on social make 78% of consumers more willing to buy from them and more urgently, 72% of consumers will spend more.

Aim to generate UGC, which can be 8.7x more impactful than influencer content due to the authenticity… but as your brand interest gains traction, keep up the positive engagement with your content creators by creating a strong community management strategy.

Demands on brands are high, so if your social media marketing needs a boost, get in touch today, and take a look at the brands we’ve worked with!

- GlobalWebIndex – 19% of Gen Z 21+ never drink alcohol

- Pinterest, global search data, analysis period Sep 2020 to Sep 2022; Sparkler and Pinterest qualitative community analysis in BR, JP, UK and the US, Sept 2022.

- Hubspot – State of Consumer Trends Report