October 29, 2025

Social is scary enough: October’s frights that unlock Q4 growth

I was going to write a Halloween screamer. But honestly, social is terrifying on a normal week, even when you’re not under pressure for Q4 growth.

Algorithms lurch like zombies. AI keeps creeping around in corners.

So, before I ham this analogy up any more, let’s skip the jump scares and focus in on what changed this month, why it matters, and where the growth sits for Q4.

Algorithms are turning the screws on quality

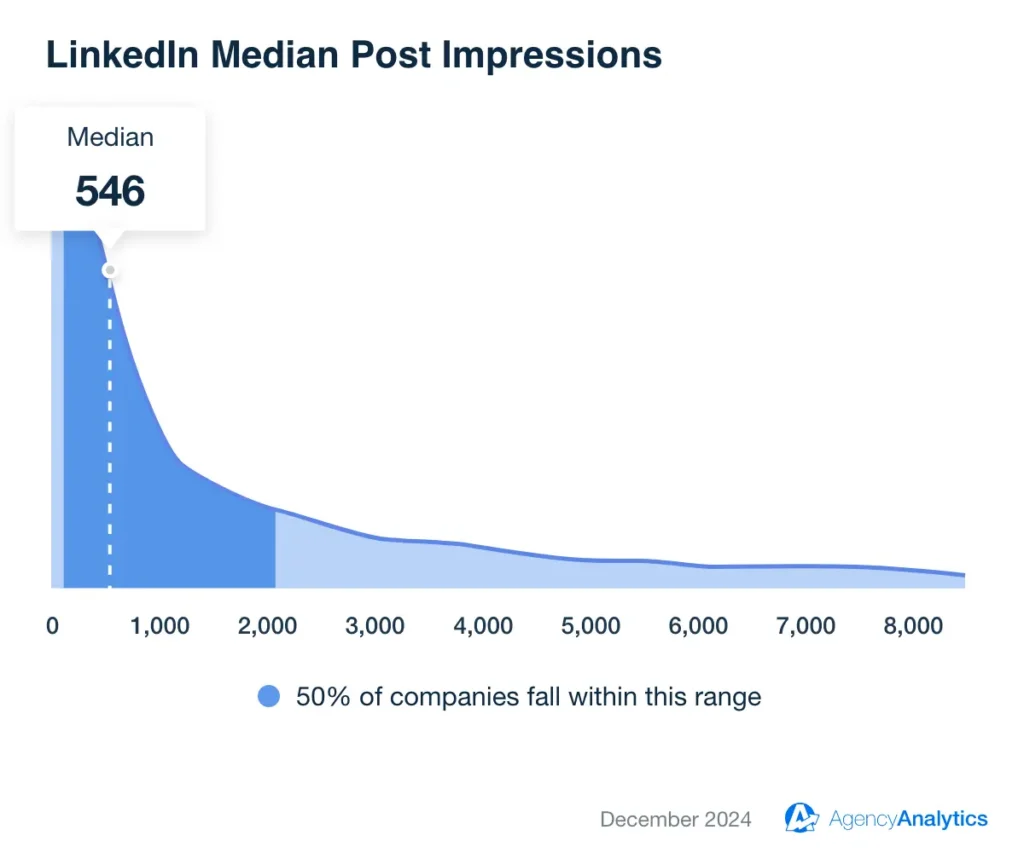

LinkedIn is openly privileging subject‑matter expertise and sustained quality. Independent tracking shows organic reach down materially year on year for many accounts, as the feed gets stricter about relevance over recency and more hostile to engagement bait. That sounds grim, but it’s actually a gift if your brand has a point of view and the patience to be remembered. Source: Richard van der Blom’s Algorithm InSights 2025 summary.

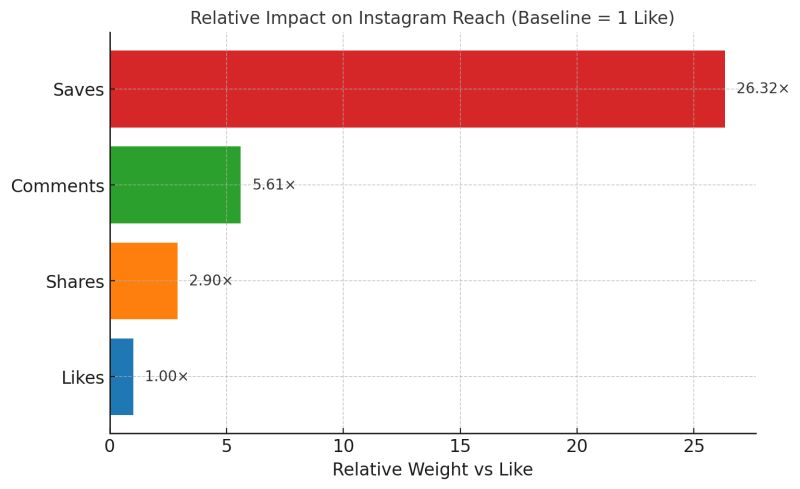

On Instagram, the ranking conversation is now plain English: watch time, likes and sends are the top signals, with “sends” carrying serious weight. Adam Mosseri said it himself in October. If people privately pass something on, the system reads that as real value. Source: Adam Mosseri on ranking signals.

LinkedIn has also confirmed that ‘dwell time’ (how long a member spends with a post) feeds its ranking models, which strengthens the tilt toward substantive updates over superficial prompts. Source: LinkedIn Engineering on dwell time.

On the policy side, LinkedIn’s Professional Community Policies explicitly discourage manipulating engagement, aligning with the feed’s tighter stance on bait tactics.

What this means for Q4 growth

Short term, expect more volatility post by post. Long term, the advantage tilts to brands that show up consistently with clarity and confidence. The feed is becoming memory‑led, not moment‑led. Distinctive brand assets and recognisable voices compound.

Social is now part of search

AI Overviews on Google are no longer a novelty. Multiple studies show rising prevalence across informational queries, with Semrush tracking growth from 6.49% of queries in January to 13.14% by March 2025. That’s not “everywhere,” but it’s enough to change behaviour and reporting. Source: Semrush AI Overviews study

Discovery paths now include social posts, answers and videos being cited in AI summaries. Separately, fresh research shows social platforms account for a meaningful slice of referral traffic, concentrated in a handful of networks. Facebook, Instagram, TikTok and LinkedIn dominate that pie, with TikTok the fastest grower for social search‑type traffic in 2025. Source: SE Ranking social traffic study.

AI visibility with be Q4 growth

Short term, expect fluctuations in click‑through from classic search. Long term, the work is to be the brand with clearly worded, cite‑able expertise that answer engines can understand and surface. Social and search are blending (worth looking at the FAQs on social search). Your credibility is judged across your footprint: the substance of your LinkedIn posts and the clarity of your YouTube titles now weigh as much as the copy on your website.

Private sharing is now public reach

Instagram crossed 3 billion monthly users in September, and the app is explicit that private forwards matter more than public vanity. Sources: Reuters and TechCrunch.

Across platforms, the centre of gravity is drifting from likes in public to sends in private. It’s a stronger signal of intent. When someone forwards a post in a DM, they are usually trying to help a colleague decide, save it for later, or support a business case. Private sends act more like recommendations than reactions, which is why platforms treat them as higher quality signals.

What this means for distribution and reporting

In the near term, shift your read on performance toward intent signals that persist beyond the first day. Distribution is increasingly shaped by user-side controls as well as engagement. Instagram has introduced topic controls that let people remove subjects from their recommendations; content can lose reach at a topic level even when reactions look fine. Source: TechCrunch.

Over the longer term, plan for longer tails and more uneven delivery as recommendation systems resurface useful items from saves and collections. Treat the reporting window as a curve (7/14/28 days) rather than a single “day one” snapshot, and read private-intent signals alongside downstream effects such as profile visits and branded search. The goal is a clearer line of sight from kept and carried content to opportunity creation.

Platform AI moves change how intent is inferred

Meta will start using your conversations with its AI to personalise content and ads from 16 December, excluding the UK, EU and South Korea at launch. No opt‑out beyond not using the AI features. That will sharpen interest signals where it rolls out. Sources: Reuters, The Verge and Financial Times.

YouTube is threading AI deeper into Studio with “Ask Studio,” pulling insights from your own data to shape packaging and planning. The direction of travel is clear: assistive AI that rewards cadence and clarity. Sources: YouTube blog

X, meanwhile, is shifting its feed towards a Grok‑powered recommendation system. Expect choppy distribution as the model trains. Sources: The Verge.

Short term this means, more signal, more noise for Q4 growth. Long term, the advantage sits with brands that can prove relevance in their own data and hold a recognisable position across channels. The algorithm changes; your distinctiveness shouldn’t.

Creator economy is still compounding, but with grown‑up expectations

The creator market sits around $250bn and is forecast to approach $480bn by 2027. That’s less about hype now, more about maturity and diversified incomes. Source: Goldman Sachs.

For brands, this is less “borrowed reach” and more an always‑on layer of credibility. Influence is infrastructure.

Social commerce keeps marching

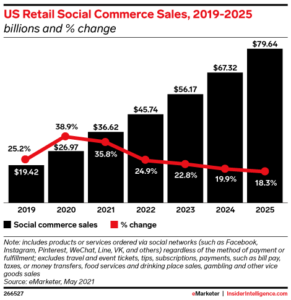

Insider Intelligence expects US social commerce to pass the $100bn mark in 2026, with TikTok a major growth driver and momentum carrying into 2028. That doesn’t mean every category jumps at once; it does mean platform journeys are normalising. Sources: Insider Intelligence and Insider Intelligence chart.

Short term, expect budget holders to push for clearer evidence that social drives revenue with less friction between discovery and purchase. Platforms are compressing the path by keeping people in‑app with native carts and checkout, reducing the number of steps before a sale; US social commerce is projected to pass $100bn in 2026, which signals this behaviour is becoming mainstream. Sources: Insider Intelligence and Insider Intelligence chart.

Longer term, the mechanics of buying will recede into the product experience: tags, carts and links will feel invisible, and purchase will sit naturally within feeds and messages. The strategic work is governance, data, consent, pricing integrity and measurement that can attribute outcomes across both platform and owned checkouts. So growth is sustainable when the interface changes again.

None of this is a horror story really. It is a bit messy and relentlessly changing though. Platforms are rewarding usefulness. AI is forcing clarity. Distribution is still there for the brave and the consistent. If you are distinctive, steady and trusted, Q4 has plenty of room to surprise you on the upside.

If you want to talk it through, we’ll put the kettle on. Or, if you’d like a straight verdict on where you stand today, we can review your social presence and give you a clean read on the levers that matter for growth with our AEO and social search audit!