April 22, 2015

Recently, I have been working with clients across a wide range of verticals in the B2B space, from pharmaceuticals to chemical engineering to sports equipment. These disparate markets have completely unique business challenges, requirements, sales processes and routes to market. However, there is one thing that many of these companies have in common – identifying their prospects on social.

It seems that the more niche the product or service on offer, the harder it can be for a company to define the people they are prospecting. Many companies have internal industry names and terminology to break down their ‘markets’ in a way that makes sense to the business. They may well even structure the business and sales teams in this way – dividing responsibility between their internally defined markets. However, as many of these companies move through their digital transformation plans, with social playing a key role, there is a need to understand how these industry definitions translate to the social space for effective prospecting.

Here are 3 ways you can ensure greater clarity over your audience and locate B2B prospects in social:

1. Use LinkedIn’s paid engine to understand how industries and the individuals within it define themselves

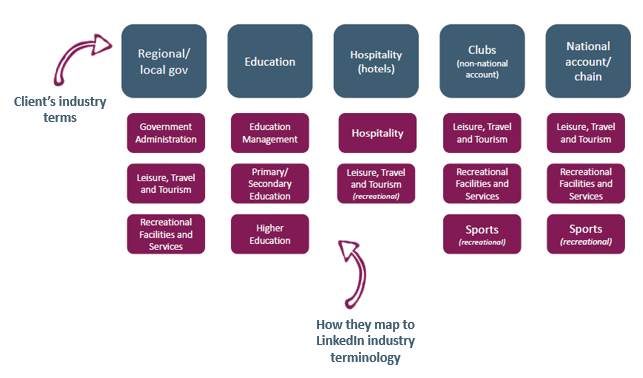

If, as an organisation, you have certain industry terminology that helps you break your markets down, this can complicate things on social. This method might be great for defining the marketing internally, but is not necessarily how people describe themselves. I will cite one example; I have recently been helping a global fitness brand scope out their B2B opportunity on social, and we found that their definitions of industry did not map to LinkedIn’s definitions (the industry choice’s that people get to choose on LinkedIn) – hence my phraseology ‘re-mapping the thinking’. Here is how we broke out the company’s defined terminology into LinkedIn terminology:

2. Use keywords and influence on Twitter

2. Use keywords and influence on Twitter

With Twitter cards, analytics, and a constant string of new and interesting functionality, Twitter is well and truly establishing itself as a powerful B2B prospecting engine. In turn, it is redefining and keeping us working hard for new ways to find and identify prospects. Unlike LinkedIn, where we have the privilege of accurate job titles and industries etc, Twitter presents new challenges for locating and defining prospects. We have found over the last couple of months that marrying carefully-tuned keywords with influence can help us to cut through the noise and carve out key industry commentators, influencers and prospects. A little tip: some of the free tools, like Buzzsumo, can help make your life easier in this space.

3. Using seniority and industries on LinkedIn to avoid dodgy job titles

I lied to you earlier – there is something else that these vastly different companies have in common. It also seems the more niche your product, the weirder and wilder your buyers’ job titles get! When selling niche products or services, it seems the buying function can sit with procurement, finance, marketing, ops, or even sales (I know, right?).

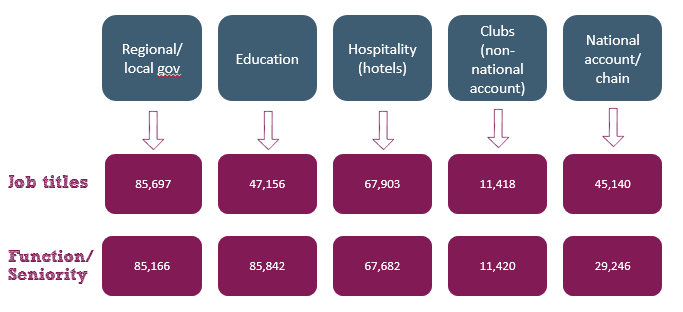

With the aforementioned fitness company, we had a similar challenge in that there were a huge array of different job titles. Below is a chart of the numbers of people we found when defining prospects using all of the job titles vs. using no job titles and defining prospects through function and seniority – the idea being that you weed out any possible quirky job title, capture all relevant ones, and make sure you get anyone that could be part of the buying function. You can see for the most part the numbers are pretty similar:

I hope this helps you on your quest to defining prospects on social.