February 18, 2026

Social commerce is growing up, it’s less about checkout, more about reducing regret

Social commerce keeps getting framed as a platform feature. Shoppable posts, live shopping, one-click checkout, the lot.

That framing misses the behavioural shift happening under our feet. People are using social to do the hardest bit of buying, the bit where they decide if something feels safe, real, and worth the hassle.

Social commerce is proof, people, then baskets.

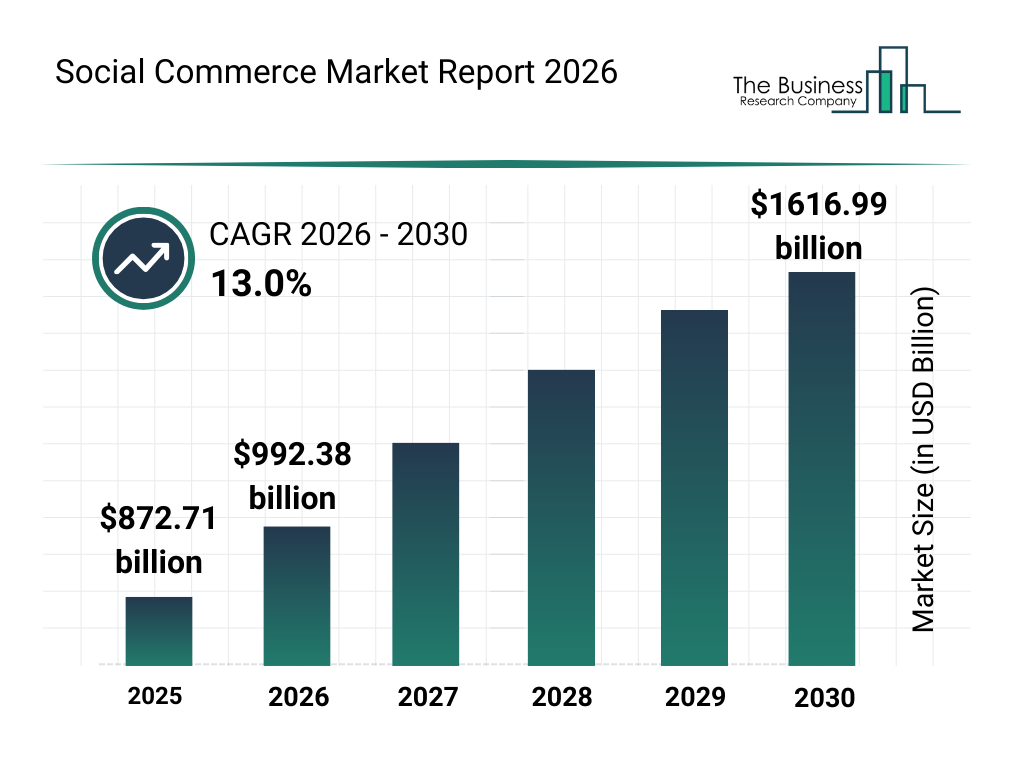

Social commerce is big enough now that it stops being a novelty

I mean the size of social commerce as a retail channel, the money going through purchases that start and happen on social. The numbers are now large enough that it’s no longer a debate about whether this is real. The debate is what kind of commercial engine you’re building, and what you’re willing to trade off to get there.

In the US, social commerce sales are forecast to pass $100bn in 2026. TikTok Shop alone is forecast at $23.41bn in US ecommerce sales in 2026, up 48% year on year.

In the UK, social commerce spend has been reported at £9.1bn. Sheesh, that is a lot!

I cannot say this enough, social commerce has stopped being “a nice little experiment”. It is a real retail outlet, which means it drags real retail consequences into your social world, margin pressure, returns, customer service expectations, and the very public reality of “does it do what it said on the video”.

Questions, decisions, baskets

This is the behavioural change that matters. People aren’t going to social to be persuaded, they’re going to social to get their questions answered quickly, in a way that feels believable.

Three things are shifting at once.

First, social has become the influence layer for shopping, especially for younger buyers. Deloitte’s 2025 Digital Media Trends found Gen Z (63%) and millennials (49%) are most likely to say ads or product reviews on social media are the most influential to their purchasing decisions.

Second, buying has become more public and more social. The proof people want is increasingly conversational, not page-based. And you need a plan for this, especially if you are breaking into a new market. They look for a demo, then scan comments for the awkward questions, then check whether real humans back up the claim. This is why “answers” now do the heavy lifting.

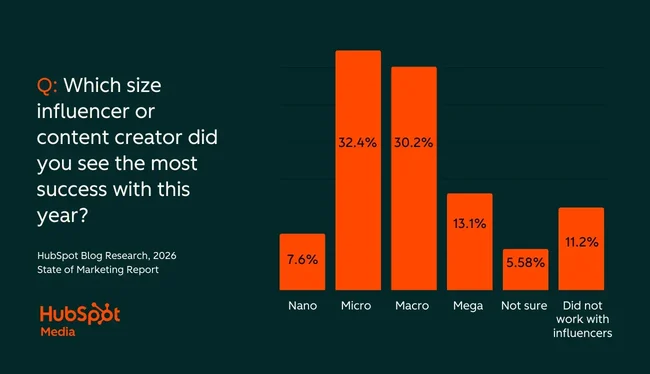

Third, commerce is getting pulled into the creator and affiliate ecosystem, because that is where trust travels. On Cyber Monday 2025, Adobe found social media drove 3.6% of US online revenue, up 56.5% year on year; and affiliates and partners (a category that includes influencers) accounted for 21.8%.

For brands, this changes the job. Social commerce is not only about making buying easier, it’s about making choosing feel safer. Your proposition is being judged in public, in real time, against practical questions people used to ask privately.

The comments are the new shop floor

This is where the shift gets challenging for brands that like controlled messaging.

In social commerce, the comments are not a “community layer”. They are the moment of decision in plain sight. People ask the things they are too tired to research properly, delivery times, returns, sizing, allergen questions, whether the colour is true, whether it breaks after a week.

When those questions get answered clearly, you can almost feel the friction disappear. When they get ignored, you can feel the doubt spread.

Social commerce performance is increasingly a function of operational truth. Your delivery promise and your returns reality are marketing, whether you planned it or not.

Creators have become the product page

Here’s the bit most teams still struggle to say out loud. A creator demo, a stitched reaction, and a pinned comment thread often do the job your product page used to do.

That is not because your site suddenly got worse. It is because social is better at compressing information into something people can trust quickly.

A creator showing the thing in a real kitchen, answering questions in real time, is a level of reassurance that brand content rarely matches.

Your “most persuasive content” and your “most shoppable content” are collapsing into the same thing. The centre of gravity is moving towards human proof, not polished claims.

Platform reality, checkout is fragmenting, the behaviour is converging

TikTok is pushing hard into in-app purchasing, live selling, and affiliate style creator commerce.

Meta has moved the other way. As of September 2025, Shops on Facebook and Instagram use website checkout.

Both paths point to the same underlying truth. Discovery and confidence-building are happening in-feed. Purchase can happen in several places. The deciding moment still happens on social.

If you are waiting for “the perfect native checkout experience” before you take this seriously, you are already late. The consumer behaviour has moved.

The seasonal proof point, social shopping is becoming normal

Over the 2025 Black Friday to Cyber Monday period, TikTok Shop saw US GMV exceed $500m. TikTok also said it saw nearly 50% more shoppers buying on TikTok Shop in the US versus the prior year’s BFCM campaign period.

In the UK, The Guardian reported over 200,000 small and medium businesses using TikTok Shop, and mainstream retailers leaning in. One example they cited, Sainsbury’s Tu Christmas pyjamas hit 6.6 million views and sold out within a week.

This is what it looks like when “shopping on social” becomes normal behaviour. It stops being niche. It becomes habit.

Once a behaviour becomes habit, it becomes expectation. The question shifts from “should we” to “how does this change what people expect from us, and what does it expose about our proposition”.

The uncomfortable trade-offs, growth can get addicted to discounts

Social commerce is brilliant at collapsing the time between wanting and buying. That is the upside.

The downside is it can also collapse brand building into a permanent state of promotion, urgency, and price chasing, especially when the algorithm rewards what sells fastest.

If you have ever watched a product become “a TikTok deal” instead of “a brand people choose”, you know what I mean.

Social commerce forces a commercial choice. Are you building repeatable trust, or are you feeding impulse. Both can drive revenue, only one tends to build a defensible brand.

Measurement is getting less forgiving, because this is commerce

Social commerce is growing up. The language around it is growing up too.

When teams keep reporting social commerce success like social, engagement, views, “strong sentiment”, it sounds like they are dodging the commercial question. When teams report it like retail, revenue, new customer mix, repeat behaviour, returns, margin, it becomes serious.

The biggest shift I’m seeing is this, the strongest stories link social behaviours to commercial outcomes, not as a neat attribution fairytale, as a credible chain of cause and effect.

The future argument is not “social drives sales”. The argument is “social changes decisions”, and you can show where that decision changed, and what it was worth.

Social commerce is becoming infrastructure

Social commerce is not a channel add-on. It is a change in how people decide what to buy. It turns discovery, proof, service, and purchase into one blended loop, and it makes that loop public.

Brands that treat it as infrastructure will feel more consistent. Brands that treat it as a campaign mechanic will keep lurching between bursts of sales and bursts of doubt.

A small closing thought

If you want to talk through how this changes your brand’s commercial story, and where confidence is leaking right now, send me a note. We’re social-only, and we spend a lot of time in the boring bits that make the exciting bits work.

Sources and reading

- EMARKETER chart, US social commerce sales will surpass $100bn in 2026

https://www.emarketer.com/chart/269287/us-social-commerce-sales-will-surpass-100-billion-2026-billions-us-social-commerce-sales-change-of-total-retail-ecommerce-sales-2022-2028 - EMARKETER, FAQ on social commerce 2026

https://www.emarketer.com/content/faq-on-social-commerce–how-creators–platforms-power-shopping-2026 - Deloitte, 2025 Digital Media Trends

https://www.deloitte.com/us/en/insights/industry/technology/digital-media-trends-consumption-habits-survey/2025.html - Meta, Shops and checkout changes

https://www.facebook.com/business/help/1314349509894768 - TikTok Newsroom, BFCM 2025

https://newsroom.tiktok.com/tiktok-shop-had-our-biggest-bfcm-weekend-ever?lang=en - The Guardian, UK TikTok Shop adoption and examples

https://www.theguardian.com/technology/2025/dec/24/uk-small-businesses-sign-up-to-tiktok-shop - Business Insider, TikTok Shop over $500m BFCM week

https://www.businessinsider.com/tiktok-shop-crossed-500-million-in-us-sales-black-friday-2025-12 - Retail Week, UK social commerce spend

https://www.retail-week.com/customer/breaking-down-the-uks-91bn-social-commerce-spend/7050123.article