June 7, 2022

Every minute internet users send over 500k tweets and 510k Facebook posts, with many of the comments containing insights on what customers think about products, brands and services that they use. The importance of positive and negative opinions is huge as they can have a strong impact on a brand’s reputation. According to recent data, about 40% of buyers make up their minds about a brand after reading 1-3 online reviews.

In today’s blog, we will discuss the recent Brandwatch report to understand what drives sentiment and what are the sentiment benchmarks by industry . The report analyses more than 140 million public mentions of nearly 550 top brands, including sentiment trends by different industries and sectors.

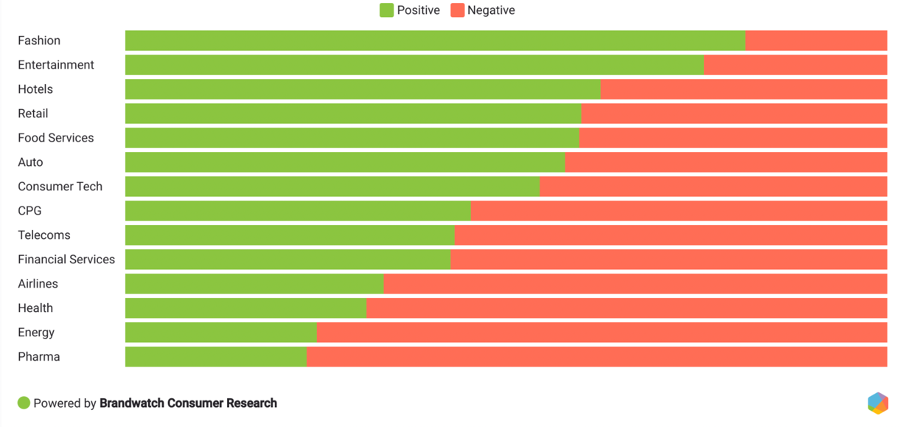

According to the Brandwatch sentiment-based data, certain industries, such as food, fashion, and entertainment, were more likely to generate positive mentions. The positive sentiment was mainly driven by influencers and celebrities popping up with Lil Nas X being named Taco Bell’s chief impact officer and Chick-Fil-A naming a drink in honour of NBA star Giannis Antetokounmpo. Consumers also enjoyed discussing the news about brands that align with their social or political views.

On the other hand, sectors such as energy, airlines, and pharma tend to generate more negative comments. “Side effects”, “supply”, and “vaccine rollouts” driven the negative discussion around pharma brands.

In these conversations, people frequently shared their opinions and experiences related to COVID and vaccines. COVID was the biggest driver of negativity in discussions around airline brands too. The typical complaints included cancelled flights, lack of communication, poor customer service and staffing shortages caused by the pandemic.

Emotion-categorised Conversations.

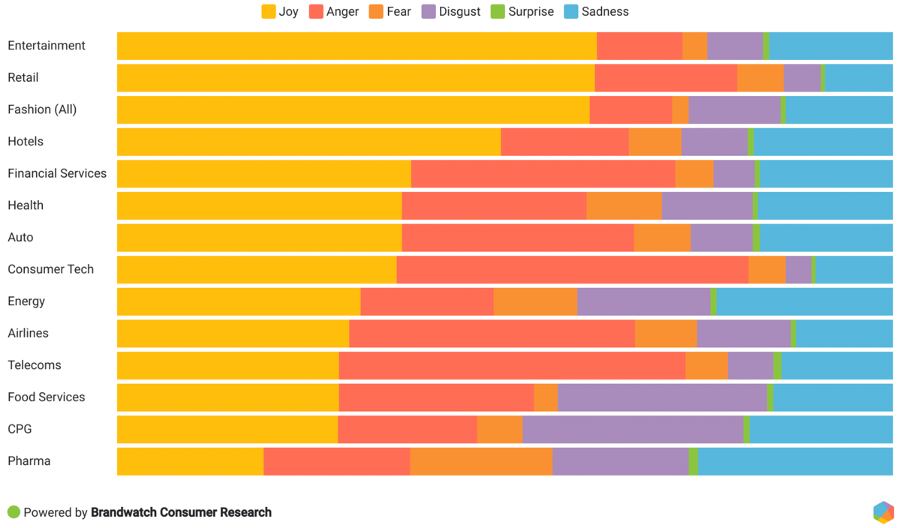

Entertainment, fashion, and retail brands were sparking joy, with 62%, 61%, and 62% of emotion-categorised mentions, respectively, identified as joyful.

Pharma had the largest proportion of fearful mentions, together with the energy, CPG and food Services. Food Services had the largest share of disgusted mentions.

Consumer Tech and Telecom Brands were the ones that sparked anger (45%). This was driven by complaints about connectivity and service.

The data shows that there is no one size fits all approach when it comes to Sentiment and Brand Health tracking. Every industry has different sentiment drivers and overall level of satisfaction, so you need to be careful when benchmarking your brand performance. Contact Immediate Future today if you want to get the most from social listening and always stay ahead of trends.