May 11, 2015

As if you didn’t know already, social media is a noisy space. And the latest research from GlobalWebIndex (GWI) gives us one of the reasons why. Because on average people have 5.39 social networking accounts. Now that is a lot of chatter!

But here’s the thing: for brands looking to reach customers, more networks does NOT mean they need to exponentially increase content, outreach, or be even noisier. Nor does it mean companies need to be on every platform.

Brands need to forensically assess each platform. Yup, that means a look at the data. Data that tells you where, how, and why to focus your attention. So, what should you be looking for?

1. Activity is a good place to start

It’s all well and good knowing the number of owned social accounts, but are people actually active on them. Whilst people signed up for 5.39 accounts, it is around 2.75 accounts that are actually active. Phew! Not quite so many.

Facebook of course dominates the numbers with 82% of members globally. When it comes to active members, the number of people drops to 43%. This number is gradually decreasing over time, but the other networks have some way to go if they are to catch up with an average daily engagement by 50% of internet users.

The devil is always in the detail – so do your homework. For instance, 24% of YouTube members are active users. However, the platform has a whopping 82% of visitors from a global audience of internet users. That’s 3.5 times as many visitors as active users.

If you are after an early adopter audience, then it is growth of active users that might provide the insight. In which case, right now, you should be looking to Pinterest and Tumblr. They are attracting active users with such rapidity (according to GWI) that they are the biggest growers from last year.

2. Audience segments count too

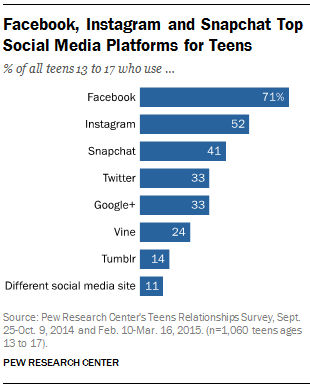

Although social media does not naturally segment around demographics (it is more often driven by interests) there is one segment that tends to ‘tribe’ together: the teens. According to Pew Research 71% of teens use more than one social network site. Facebook, Instagram and Snapchat dominate the networks of 13-17 year old Americans.

In the UK the platforms differ slightly for 15-18 year olds. With British internet teens with active accounts on Facebook (89%), Twitter (62%) and Snapchat (58%)

3. Behaviours deepen the insight

Behaviours fall into three types. The first is what is driving network interests. GWI data shows that 26% of US/UK internet users are interested in Facebook At Work, with the figure peaking at 49% among LinkedIn users. Demonstrating an interest in work or business interest.

The second behavioural difference is in social network access across devices (differences between desktop and mobile for instance). Recent research shows it is mobile apps that make ‘snacking’ on social media easier. Frequent use is also a likely driver for increases in social media accounts.

The third type of behaviour is more sector specific. Our recent social travel report reveals where people are interested in a brand or sector, depending on where they are in the customer purchase journey. This research shows that holiday travellers are more likely to engage in social media during or after a holiday than before. This is powerful insight. It takes time to analyse, but delivers deeper behavioural insight and thus greater opportunity for ROI.

4. Attitudes add further flavour to behaviours

Sitting alongside behavioural data, consumer attitudes is an indicator of what people think of the platforms as well as what they then go on to do on the social network. FOMO (fear of missing out) or social pressure to confirm can often be a driver for social activity. And GWI research reveals that YouTube is seen as the ‘coolest’ platform by teens. These attitudes inform the brand as to the best approach – ensuring content mirrors the same outlooks.

Attitudes impact more than social media though. Apparently almost one third of Brits (28%) admitted they buy new clothes just to avoid being multi-tagged in the same outfit on social media. Attitude can be a driver for ROI too!

Of course, this list of key assessments is not exhaustive. Location, topic segmentation and gender might also play a part on focusing your social strategy. But it is a good starting point. Don’t be tempted to rush to every new social network. Take your time and plan. That way you can ensure you deliver results, don’t drain your resources and have enough investment to work them properly.